VFBV continues to educate the community on the Victorian Government's new Emergency Services Tax, that replaced the previous Fire Services Property Levy that used to only fund CFA and FRV.

While the previous levy only funded fire services, the new tax expands the number of agencies it now covers, including a number of Victorian Government Departments. All new entities added to the Tax were previously funded from consolidated revenue. Therefore, the new Emergency Services Tax constitutes a cost shift, with no corresponding reduction in taxes. It is VFBV's view that this highlights the disingenuous claims that the new tax would inject significant new money into emergency and volunteer services in order to deal with increased demand.

Under the new arrangements, the government is required to table each year's funding allocations from the new tax, via Government Gazette. The most recent gazette was published on the 30th May 2025 and demonstrate far from the claim that the additional taxes raised would boost CFA and SES budgets, they have in many cases received less funding than previous, with now 30% of the taxes raised being diverted to government entities previously funded from consolidated revenue.

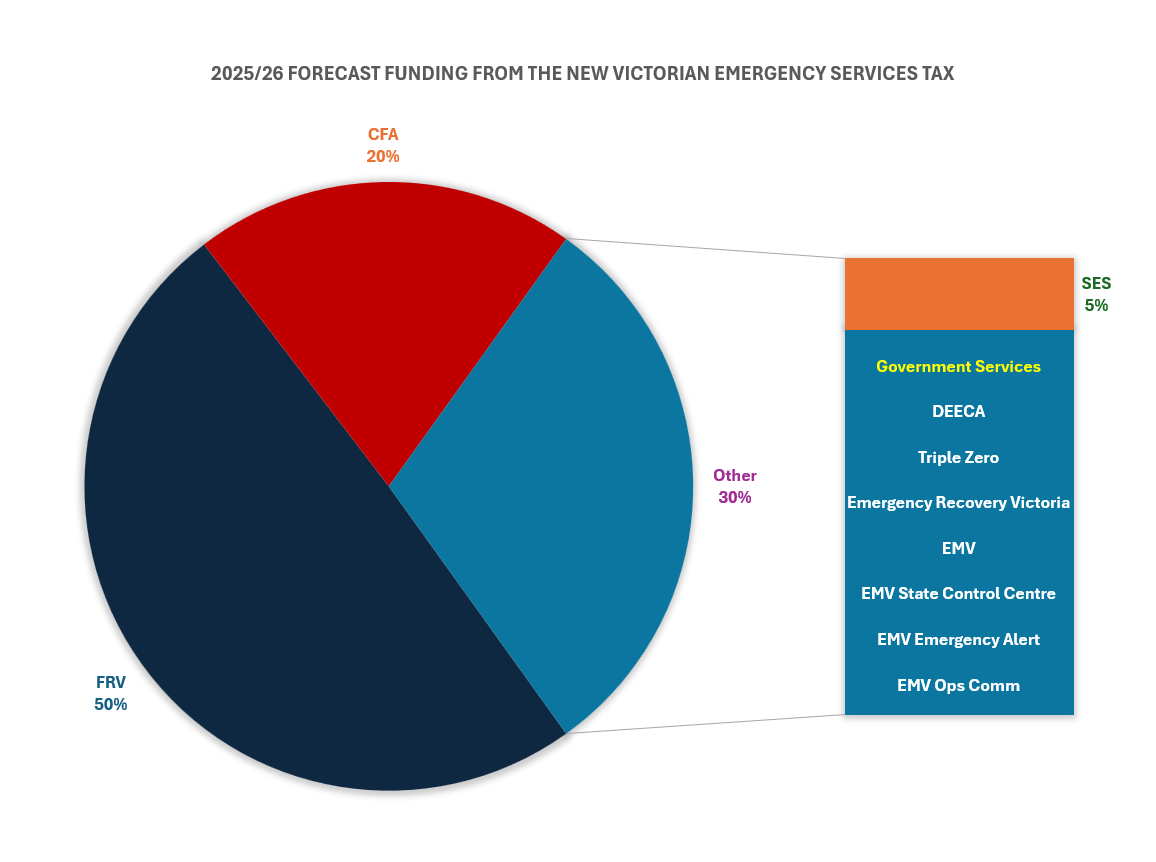

The chart below illustrates the amount of funding allocated to each agency and department for the 2025/26 financial year.

This is based on the following Victorian Government figures published on 30th May 2025:

| Funding Recipient | Forecast Funding | % of TOTAL TAX COLLECTED |

| FRV | $ 761,772,628 | 49.5% |

| CFA | $ 312,004,751 | 20.3% |

| SES | $ 72,963,592 | 4.7% |

| DEECA | $ 173,614,597 | 11.3% |

| TripleZero | $ 107,537,038 | 7.0% |

| EMV | $ 10,951,805 | 0.7% |

| Control Centre | $ 174,973 | 0.0% |

| ERV | $ 12,240,349 | 0.8% |

| Emergency Alert | $ 8,871,420 | 0.6% |

| EMV Ops Comm | $ 78,100,915 | 5.1% |

| $ 1,538,232,068.00 |

As the above figures show, CFA is chronically underfunded and relies on the good will of volunteers to fundraise in their community to raise precious funds for the purchase of essential trucks and equipment that keep Victorian’s safe. We believe this new tax and the way it is being communicated will significantly hurt these efforts, and many Victorians will mistakenly believe that CFA is now fully funded. CFA volunteers want all Victorians to know that only 20 cents in every dollar raised by the Victorian Government's new Emergency Services Tax goes to CFA, and they still rely on the communities goodwill and support to fund essential equipment that protects their communities.

We do not support a new Tax on emergency services that is disingenuously being redirected to pay down government debt, and resent the government pretending that this new tax benefits volunteers.

CFA and SES are the only two agencies in the list above that involve front line emergency service volunteers funded from this new tax, with only 20% going to CFA, and 5% going to SES. The remaining 75% of the tax revenue is going to fully staffed agencies and government departments. EMV, the State Control Centre, ERV, Emergency Alert and the EMV Ops Comm program are all entities that sit within the Victorian Department of Justice and Community Safety, and are all staffed by Victorian public servants.

Calling this new tax a volunteer fund is divisive, inflammatory and significantly erodes the morale of CFA volunteer firefighters who are frequently engaging with their communities as volunteers. Calling it a volunteer fund is plain mischievous and misleading, and we believe is only being done to try and play on the community’s respect for volunteers to protect from backlash over the new tax.

News

News